Sunday, November 23, 2008

Monday, November 3, 2008

Hansen Natural Equity Analysis

Hansen Natural Business Analysis

- Hansen has created a strong brand (Monster)

- Distribution contracts with major Coke and Bud distributors in US as well as six European countries

- Firms don’t compete on price

- Psychological barriers to switching brands

- Coffee gives bad breadth and brown teeth; energy drinks avoid such problems and have no taste memory

- Incumbents can leverage economies of scale

Monday, September 22, 2008

Phillip Morris International: A costless call option on growth in emerging markets

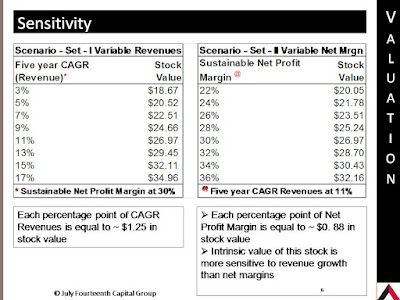

Scenario & Sensitivity Analysis: A scenario analysis shows that PM’s current stock price reflects low short term revenue growth at 2% or a low sustainable net profit margin of 7%; either one of which has a low probability. PM’s intrinsic value is more sensitive to net profit margins; each percentage point in net margins is equivalent to $5.5/share of intrinsic value. Net profit margins at PM have been very stable and is unlikely to change anytime soon.

Tobacco producers are scattered around the world and hence don’t have a lot of bargaining power while negotiating prices for their produce. On the other hand, consumers can easily switch to cheaper brands if the economic conditions warrant such a change and so brand recognition is the key to retaining consumers. A variety of products compete for the consumer’s tobacco dollars, however, once a consumer is addicted to cigarettes, it is difficult for other products to gain prominence.

In Dec 2007, PM formed a joint venture with China National Tobacco to manufacture PM branded cigarettes in China and are expected to hit the markets in Q3-2008. PM’s Asian revenues (excluding China) grew at a CAGR of 9% in the past three years and the introduction of PM brands in China could push this growth rate into double digits in 2009-2010. Similarly, India is another growing market for cigarettes and PM is in talks to manufacture Marlboro locally. Chinese and Indian growth has not been factored in the valuation model so far since it is not expected to be materially significant in the next few quarters. In the last three years, EMEA has been the fastest growing region with a CAGR of 11%.

All insiders including the CFO have bought shares in the $50 range without a single insider sell transaction below $52 in the last six months. In May 2008, PM announced a $13 billion two-year share repurchase program; as of Q2-2008, it has spent $2.1 billion out of the $13 billion approved by the Board of Directors. PM’s three year $1.5 billion productivity and cost savings program is on track with the first big element of resourcing of volume from USA factories to PMI factories expected to be about two months ahead of schedule.

An increase in inflation world-wide could hurt PM’s sales since it sells premium brands and most of its new customers trade-up from local cigarette brands. However, in case of PM, inflation is a double edged sword: it could mean weak sales for PM in certain regions but the underlying reason for world-wide inflation is that more consumers have resources to buy goods, which increases the international customer base for PM products.

Litigation costs and increasing regulation in developed countries is a major concern for tobacco companies. PM doesn’t generate revenues from US and is unlikely to be liable for any litigation in US; it is also immune to any future US regulation. Anti-tobacco laws in other regions of the world are not strict enough to cause any material impact on PM’s bottom-line. The recent acquisition of Rothmans in Canada is the only major source of litigation risk for PM.

Overall, PM has limited downside risk in current volatile market conditions with above average growth potential owing to its strong brands and low penetration in major emerging market countries such as China, India and Vietnam.

Monday, September 8, 2008

Monday, July 28, 2008

Nike Equity Analysis

Portfolio Suitability: In the last three years, Nike’s correlation to consumer discretionary sector is at 0.01. In simple terms, for the last three years, Nike’s stock doesn’t have any relation to the movement of consumer discretionary sector. So, even though Nike is considered to be a consumer discretionary stock, its stock isn’t behaving in line with the sector. The reason for this anomaly could lie in the fact that most consumer discretionary stocks are heavily dependent on US for their revenues while Nike isn’t. Infact, Nike’s three year correlation to the consumer staple sector is at 0.91 and at 0.89 to the utilities sector. This reinforces the theory that Nike will not be severely affected by a further slide in the US economy.

Sector Performance: Nike belongs to the consumer discretionary sector, a sector which we have been underweight since we started seeing some signs of an economic downturn in the US in June (2007) when an inverted yield curve puzzled everyone. An inverted yield curve is almost always a leading indicator of an economic slowdown since forward yields are low in one of the two circumstances; either the GDP growth is expected to decline or inflation is expected to decrease. However, with central banks worldwide having trouble keeping inflation at bay, the possibility of decline in GDP growth was more realistic. A decline in GDP wouldn’t bode well for the consumer discretionary sector and so we have been underweight on that sector for quite some time now. In the first half of 2008, we have seen a slowdown in GDP growth coupled with high inflation. However, the yield curve is now upward sloping and so GDP growth is expected to pick-up sometime next year (2009). This begs the question if it is a good time to get back into the consumer discretionary sector while it is still reeling from an effect of a downturn and selling at a discount; XLY - Consumer Discretionary SPDR - is selling close to its five year lows in the mid 20s. The yield curve is just one indicator of GDP growth and so I looked at performance of XLY during the last economic recession;  I used the last recession as a point of comparison since the macroeconomic conditions would be the closest, if not the same, for companies operating in the last 10 years. As we can see in the first chart, XLY underperformed S&P only for one year – 2000 - during the last recession. We want to check the performance of XLY in the last one year; the next chart compares XLY’s performance with S&P in the last one year and it has

I used the last recession as a point of comparison since the macroeconomic conditions would be the closest, if not the same, for companies operating in the last 10 years. As we can see in the first chart, XLY underperformed S&P only for one year – 2000 - during the last recession. We want to check the performance of XLY in the last one year; the next chart compares XLY’s performance with S&P in the last one year and it has  underperformed the S&P by about 10 percentage points. However, given the current credit market turmoil, I was still a little wary of this sector. Focusing on companies with extensive international exposure would mitigate the risk of a prolonged downturn in the US markets and Nike tops that list, moreover, Nike is underpriced which makes for a good value investment.

underperformed the S&P by about 10 percentage points. However, given the current credit market turmoil, I was still a little wary of this sector. Focusing on companies with extensive international exposure would mitigate the risk of a prolonged downturn in the US markets and Nike tops that list, moreover, Nike is underpriced which makes for a good value investment.

I used the last recession as a point of comparison since the macroeconomic conditions would be the closest, if not the same, for companies operating in the last 10 years. As we can see in the first chart, XLY underperformed S&P only for one year – 2000 - during the last recession. We want to check the performance of XLY in the last one year; the next chart compares XLY’s performance with S&P in the last one year and it has

I used the last recession as a point of comparison since the macroeconomic conditions would be the closest, if not the same, for companies operating in the last 10 years. As we can see in the first chart, XLY underperformed S&P only for one year – 2000 - during the last recession. We want to check the performance of XLY in the last one year; the next chart compares XLY’s performance with S&P in the last one year and it has  underperformed the S&P by about 10 percentage points. However, given the current credit market turmoil, I was still a little wary of this sector. Focusing on companies with extensive international exposure would mitigate the risk of a prolonged downturn in the US markets and Nike tops that list, moreover, Nike is underpriced which makes for a good value investment.

underperformed the S&P by about 10 percentage points. However, given the current credit market turmoil, I was still a little wary of this sector. Focusing on companies with extensive international exposure would mitigate the risk of a prolonged downturn in the US markets and Nike tops that list, moreover, Nike is underpriced which makes for a good value investment.  In the last one year, Nike has outperformed the S&P by about 15 percentage points while XLY has underperformed the S&P by 10 percentage points. Clearly, Nike is not following declines of the consumer discretionary sector in this downturn and that could be because of its extensive international exposure. In 1999-2000, Nike’s revenues from US were at 52% while 34% of Nike’s TTM revenues are from US. The recent slide in Nike’s price is attributed to flat orders from US for the rest of 2008 and so a slowdown in the US is already priced in the stock. The market ignored Nike’s excellent performance in the international segment. Nike’s revenues are well diversified and a slowdown in any one region of the world is less likely to have a significant impact on Nike’s overall performa

In the last one year, Nike has outperformed the S&P by about 15 percentage points while XLY has underperformed the S&P by 10 percentage points. Clearly, Nike is not following declines of the consumer discretionary sector in this downturn and that could be because of its extensive international exposure. In 1999-2000, Nike’s revenues from US were at 52% while 34% of Nike’s TTM revenues are from US. The recent slide in Nike’s price is attributed to flat orders from US for the rest of 2008 and so a slowdown in the US is already priced in the stock. The market ignored Nike’s excellent performance in the international segment. Nike’s revenues are well diversified and a slowdown in any one region of the world is less likely to have a significant impact on Nike’s overall performa nce.

nce.

Subscribe to:

Comments (Atom)